Important Update:

Current Short-Term Disability (STD) coverage ends 12/31/2025.

To continue coverage with voluntary, employee-paid STD effective 01/01/2026, you must elect during Open Enrollment.

Short term disability payments from The Standard, will be reduced by the Paid Family Medical Leave (PFML) benefit amount.

To report a STD or LTD claim

Short Term Disability Coverage - Employee Paid

Benefit eligible employees can elect to purchase voluntary short-term disability coverage the first of the month following 90 days of employment.

If you’re missing time from work due to your own medical condition, and are in a benefit-eligible position, you may qualify for disability pay. It will be your responsibility to contact The Standard to start your disability claim. Contact information for The Standard is listed in the FAQ below.

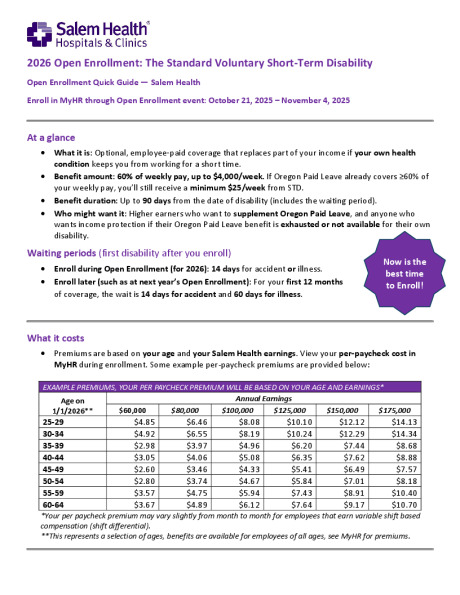

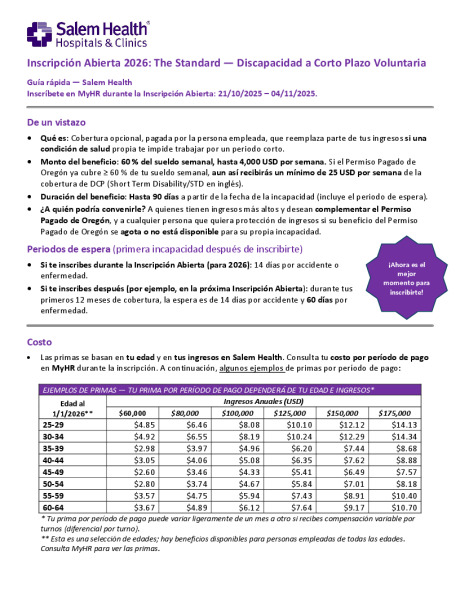

| Short-Term Disability Insurance | ||||||

|---|---|---|---|---|---|---|

| Gross-weekly benefit | Maximum gross-weekly benefit | Benefit waiting period | Maximum benefit period | |||

| 60% of your weekly covered earnings | $4,000 | 14 Days Accident 14 Days Sickness* |

90 Days for Accident 90 Days for Sickness | |||

*Employees that enroll after they are initially eligible, such as at a future open enrollment period will have a 60 day waiting period for sickness, for the first 12 months of coverage.

The Standard: STD FAQ

Long-Term Disability - Employer Paid

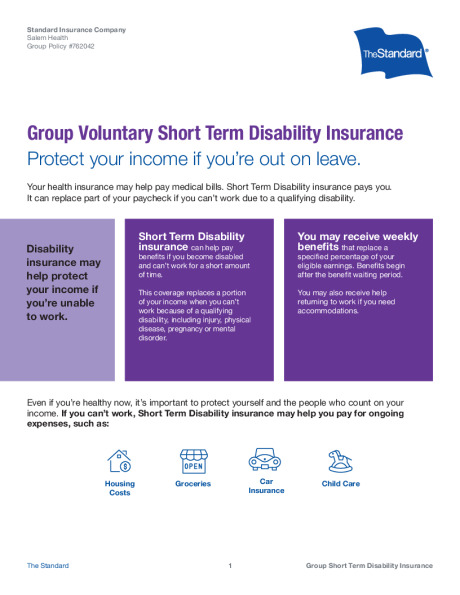

Examples:

- Cancer

- Pregnancy

- Mental health issues

- Fractures

- Long term recovery from accident

- No need to file a claim. Benefits seamlessly transition from Short Term to Long Term Disability.

- Pre-Existing conditions apply – coverage will not be payable to a condition or injury previously incurred prior to obtaining coverage

| Long-Term Disability Insurance | ||||||

|---|---|---|---|---|---|---|

| Gross-monthly benefit | Maximum monthly gross benefit | Benefit waiting period | Maximum benefit period | |||

| 60% of your monthly covered earnings | $7,500 | 90 days | Social Security Normal Retirement Age* | |||

24 months – SSNRA if you are unable to perform in any occupation and have at least a 40% loss of earnings.

All plans have exclusions and limitations. See Appendix B for more information.