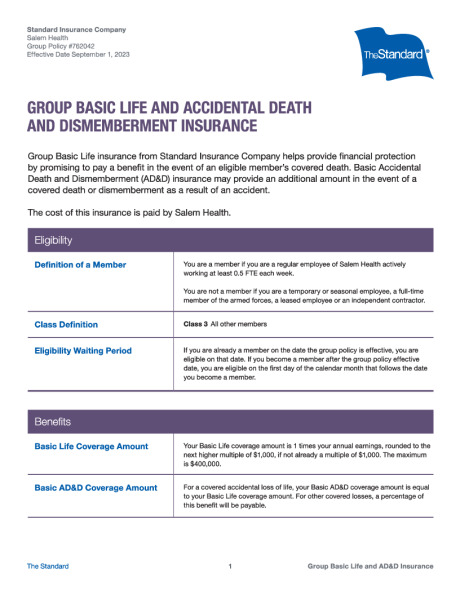

Salem Health provides employer-paid Basic Life and Accidental Death and Dismemberment (AD&D) insurance to provide a financial security net for you and your family if the unthinkable happens.

2026 Open Enrollment: CLICK HERE or scroll down to the Voluntary Life section of this page for Open Enrollment specific information.

Basic Life — Paid by Salem Health

The Basic Life and Accidental Death and Dismemberment (AD&D) insurance amount of coverage, under each plan, equals 1X your annual base salary, up to a maximum of $400,000.

Additionally, you may purchase Voluntary Life Insurance through The Standard.

| Basic Term Life and AD&D | ||||||

|---|---|---|---|---|---|---|

| Basic Term Life -- Employer Paid | Benefit amount | Maximum | Guarantee issue | |||

| Employee | 1 x your annual earnings | $400,000 | $400,000 | |||

| Basic AD&D -- Employer Paid | Benefit amount | Maximum | Guarantee issue | |||

| Employee | 1 x annual earnings | $400,000 | $400,000 | |||

Keeping your beneficiary information updated ensures that any proceeds from the life insurance coverage that you have goes to the people or entities you wish.

Voluntary Life

If you want additional protection, you can elect Voluntary Life Insurance for yourself and your dependents. You pay the cost of this coverage through convenient after-tax payroll deductions.

Note: If both you and your spouse and/or child(ren) are benefit-eligible employees of Salem Health, you may not double-cover each other.

To determine how much voluntary life insurance will cost you per pay period, visit the Voluntary Life Insurance Calculator*.

* Link will only work while on Salem Health network.

| Voluntary Term Life | ||||||

|---|---|---|---|---|---|---|

| Employee Paid | Benefit amount | Maximum | Guarantee issue | |||

| Employee | Units of $25,000 | $600,000 | $300,000 | |||

| Spouse | Units of $25,000 | $600,000 not to exceed 100% of the employee's benefit | $50,000 | |||

| Child Birth to age 26 |

$10,000 |

$10,000 |

$10,000 |

|||

Keeping your beneficiary information updated ensures that any proceeds from the life insurance coverage that you have goes to the people or entities you wish.

2026 Open Enrollment

Voluntary Life Insurance

During open enrollment you may enroll in, increase or decrease your voluntary life insurance election to help your family cover future expenses due to a death.

- For employees with active coverage, you may increase your coverage amount in $25,000 increments up to a total of $100,000. Coverage amounts greater than $300,000 will be subject to evidence of insurability.

- For spouse/domestic partner with active coverage, you may increase their coverage amount by $25,000. Coverage amounts greater than $50,000 will be subject to evidence of insurability.

- For employees, spouses/domestic partners who don’t have active coverage and want to enroll in voluntary life, all amounts are subject to evidence of insurability.

- Spouse/domestic partner coverage amount cannot exceed the employee’s coverage amount.

However, Evidence of Insurability requirements will not be waived if you previously submitted evidence of good health that was not approved.

Evidence of Insurability (EOI)

As a new hire or newly benefit eligible employee you can elect up to the Guarantee Issue (GI) amount of $300,000 of coverage for yourself and $50,000 for your spouse without having to go through EOI.

For any amount above the GI coverage levels an Evidence of Insurability (EOI) is required, and you will receive an email with instructions to complete Your coverage over the GI takes effect once your EOI is reviewed and approved.

Common Life Insurance Terms:

Accidental Death Insurance (AD&D): Generally an add-on to a regular life insurance policy, it is only paid if the death of the insured occurs as the result of an accident.

Age Reductions: Most insurance policies reduce your life insurance benefit as you age.

Beneficiary: The person or party named by the owner of a life insurance policy to receive the policy benefit.

Contingent beneficiary: The party designated to receive proceeds of a life insurance policy following the insured’s death if the primary beneficiary predeceased the insured.

Conversion: If you ever leave employment, you may be able to convert the group policy into an individually owned life insurance policy.

Coverage Amount: Value of life insurance.

Portable: If you ever leave employment, you may be able to port the life insurance coverage to a new plan.

Premiums: Amount paid to the insurance company to buy a policy and keep it in force.

Term Life: You pay a premium for a period of time – typically between 10 and 30 years – and if you die during that time a cash benefit is paid to your family (or anyone else you name as your beneficiary).