Leave of Absence

This page is designed to make the leave process straightforward for both employees and leaders. It explains how to report a leave, apply for paid benefits through Paid Leave Oregon (PLO), and understanding protected leave while staying aligned with company policies and state and federal requirements. The process applies to both continuous and intermittent leaves. Whether you’re requesting time off or supporting someone who is, these steps help ensure accurate tracking, timely communication, and a smooth experience for everyone.

Step 1: File Your Leave with The Standard

- All leaves of absence must be reported to The Standard for tracking under company policy and compliance with federal and state laws. This step is required even if you apply for benefits through Paid Leave Oregon.

As Salem Health’s Leave of Absence Administrator, The Standard:

- Track leave utilization to maintain records of employee time off.

- Monitor FMLA/OFLA leave balances to ensure employees and leaders have clear visibility into available remaining time off.

- Ensure compliance with all applicable leave laws and company policies.

Step 2: Apply for Paid Benefits Through Paid Leave Oregon

- Submit your application via the Frances Online Portal:

https://paidleave.oregon.gov/ - Review the Paid Leave Oregon Guidebook, Employee Toolkit, and Checklist for required details. You may need the following information when you create an account.

-

Tax ID Numbers:

- Salem Health: 93-0579722

- West Valley Hospital: 43-1960221

-

BIN Numbers:

- Salem Health: 00555075-3

- West Valley Hospital: 01157863-3

-

Tax ID Numbers:

Employee Responsibilities:

- Inform your leader of the nature of the absence and the anticipated duration, per the Attendance and Absence Management. Do not share your diagnosis details.

- Contact The Standard promptly to initiate your leave request. FMLA/OFLA leave must be initiated within 30 calendar days, and intermittent leave absences (including sick child) must also be reported within 30 calendar days. These deadlines align with Paid Leave Oregon’s timely filing requirements.

- Apply through Frances Online if you want to receive Paid Leave Oregon benefits.

-

Submit medical certifications and paperwork to both The Standard and Paid Leave Oregon on time.

- Report any changes regarding your leave to The Standard, Paid Leave Oregon (PLO)and to your leader.

-

Send return-to-work notes to absence@standard.com and adaservices@standard.com

- If restrictions/limitations apply, ADA accommodations may be available through The Standard. More information and resources are included under Workplace Accommodations further down on this page.

-

Follow company policies on Leave of Absence and Paid Time Off.

- Refer to the Paid Time Off policy and the Daily Dose post for use of company paid time while on a leave of absence

- Employees should make reasonable effort to schedule medical appointments outside of their work schedule, so as not to disrupt business operations.

- If your timecard indicates you are on leave after returning, notify your leader so they can update the Leave of Absence team.

Employee Resources:

Maternity Leave Resources

For more resources and information on Maternity and Paternity employee benefits, click here.

The Standard:

- Two-Way Texting with live customer service representative

- Overview of Absence & Disability – intake and claim adjudication, return to work, and ADA accommodation process and timelines

- What leave laws apply to Oregon employees – Oregon Leaves Overview

- Certification of Health Care Provider for Employee’s Own Health Condition or Pregnancy

-

Certification Form for Family Member’s Health Condition

- Family Member includes a leave for Child, Parent, Spouse, Partner, Parent-in-law, Grandparent, Grandchild, Relative

Paid Leave Oregon:

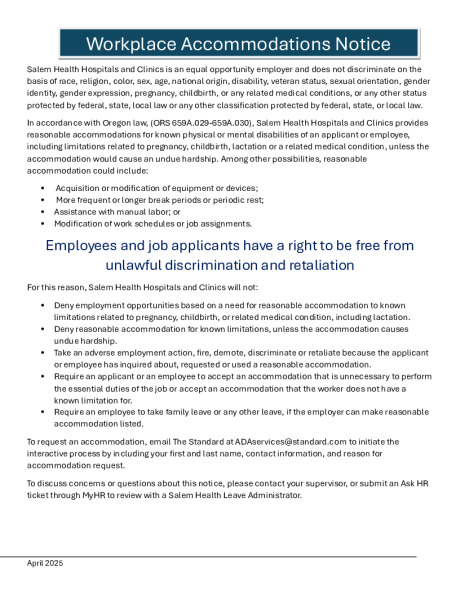

Workplace Accommodations

Salem Health will make reasonable accommodations for known physical or mental disabilities of an applicant or employee as well as known limitations related to pregnancy, childbirth or a related medical condition, such as lactation, unless the accommodation would cause an undue hardship. Among other possibilities, reasonable accommodations could include:

- Acquisition or modification of equipment or devices.

- More frequent or longer break periods or periodic rest.

- Parking modification.

- Assistance with manual labor.

- Modification of work schedules or job assignments.

All accommodation requests are to be submitted to our leave and ADA administrator, The Standard:

1. Email an ADA specialist at ADAservices@standard.com

2. In your email, include:

- Your first and last name

- The best way to contact you (phone number, email, etc.)

- Reason for the accommodation

The Standard team will then reach out to the employee and begin the interactive process necessary to discuss and determine any potential reasonable and effective accommodations. A summary of the ADA Accommodation Services with The Standard including frequently asked questions can be found here.

For Leaders

As a leader, it is your role to support employees so that they are aware of their responsibilities for managing their leave of absence. It is also your responsibility to work with The Standard through the ADA interactive process. The Salem Health leave of absence team is also available to you for assistance.

Step 1: Review this training to help you navigate absence management as a leader at Salem Health.

This training covers:

- Types of leave available in Oregon

- Reasons employees may request a leave of absence

- Oregon leaves laws and eligibility

- Who qualifies as a family member

- How leave can be taken (continuous, intermittent, or reduced schedule)

- Your role as a leader in managing absences

- The employees’ responsibilities during their leave

- The leader’s role in processing leaves requests

- Do’s and don’ts regarding protected leave

Step 2: Use the Leave of Absence Standard Work for Leaders to assist each time a staff member notifies you of a need to miss work that may fall under a protected leave reason.

Step 3: Review the following additional resources for Leaders

Step 4: Contact the Salem Health Leave of Absence Team for assistance

Health Insurance:

[1] OAR 839-009-0270(6)(b) [2]OAR 471-070-1330(7)(b)

Paid Time Off

Salem Health provides time off to eligible employees in the form of Paid Time Off and Oregon Paid Sick Leave. Paid Time Off benefits apply only to regular full-time and part-time employees. All employees are eligible for Oregon Paid Sick Leave.

For more detail, see the policy.

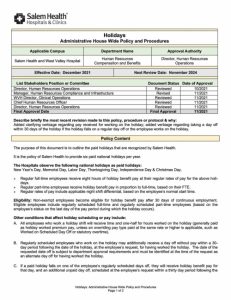

Company Paid Holidays

Salem Health observes the following national holidays as paid holidays:

- New Year’s Day

- Memorial Day

- Juneteenth

- Labor Day

- Thanksgiving Day

- Independence Day

- Christmas Day

For more detail, see policy below.