Leave of Absence Update

Effective January 1, 2025:

Beginning January 1, 2025, Paid Family and Medical Leave (PFML) will be administered directly through the State plan, also known as Paid Leave Oregon (PLO).

However, all leaves of absence, including extensions of current leaves, modifications to existing leaves, and new leave requests, must continue to be reported to The Standard. The Standard will remain responsible for administering these leaves in accordance with federal, state, and company leave policies.

The Standard will continue to:

- Track leave utilization to maintain records of employee time off

- Monitor remaining leave balances to ensure employees have clear visibility into available remaining time off

- Ensure compliance with all applicable leave laws and company policies

For PFML/PLO claims approved before January 1, 2025:

If you have approved continuous or intermittent PFML/PLO claim that began and was approved prior to January 1, 2025, The Standard will continue managing your claim until either:

- The previously certified period ends, or

- The end of the leave year,

(whichever happens first)

You will not need to file with or contact the State for claims that were approved prior to January 1, 2025. Please note, if your claim was approved prior to January 1, 2025, and you require an extension beyond your originally approved certification, you may be required to file for benefits with the State for the additional leave. Contact The Standard before your certified leave period ends, to avoid disruptions and for instructions specific to your case.

For PLO claims starting on or after January 1, 2025:

If your leave begins on or after January 1, 2025, there are two steps you must complete:

Step 1:

- You must file your leave with The Standard to ensure proper tracking under company policy and federal/state laws.

- This step is required even if you apply for benefits through PLO with the State.

Step 2:

- Submit an application through the Frances Online Portal.

- More information and access to the portal can be found here: https://paidleave.oregon.gov/.

For more information, please review the FAQ here

Employee Responsibilities:

- Inform your leader the nature of the absence and the anticipated length of time you will be off work, if known, per the Attendance and Absence Management policy. You are not to provide any diagnosis information when notifying your leader.

- Contact The Standard to file your leave request promptly. FMLA/OFLA leave must be initiated within 30 days, and intermittent leave absences (including sick child) must also be reported within 30 days. These deadlines align with Paid Leave Oregon’s timely filing requirements.

-

Starting January 1st, 2025 – Submit an application in the Frances portal if you want to receive pay benefits under Paid Leave Oregon (PLO) AFTER you have started a leave of absence with The Standard.

- Review the ‘What you need to apply for Paid Leave Oregon benefits checklist’

- Tax ID #’s: Salem Health: 93-0579722 West Valley Hospital: 43-1960221

- BIN #’s: Salem Health: 00555075-3 West Valley Hospital: 01157863-3

- Review the Employee Toolkit for information to apply for Paid Leave benefits

- Review the Paid Leave Oregon Guidebook for more details

- Contact Paid Leave Oregon for questions regarding paid leave

- Review the ‘What you need to apply for Paid Leave Oregon benefits checklist’

- Return paperwork including medical certifications directly to The Standard and Paid Leave Oregon (PLO) on time

- Report any changes regarding your leave to The Standard, Paid Leave Oregon (PLO) and to your leader

- Send return to work notes to absence@standard.com and adaservices@standard.com

- If you have restrictions and require a job accommodation you may be eligible under the American with Disabilities Act (ADA). The Standard provides ADA Accommodation Services on behalf of your employer.

- Follow employee responsibilities as outlined in the Leave of Absence policy

- Refer to the Paid Time Off policy and the Daily Dose post for use of company paid time while on a leave of absence

- If your timecard reflects that you are still on a leave of absence when you have returned to work, let your leader know the date you returned to work so they can notify the Leave of Absence Administrators to get your status updated.

- For Intermittent Leaves – Contact The Standard to file your leave request promptly. FMLA/OFLA leave must be initiated within 30 days, and intermittent leave absences (including sick child) must also be reported within 30 days. These deadlines align with Paid Leave Oregon’s timely filing requirements.

- Employees should make reasonable effort to schedule medical appointments outside of their work schedule, so as not to disrupt business operations.

Workplace Accommodations

Salem Health will make reasonable accommodations for known physical or mental disabilities of an applicant or employee as well as known limitations related to pregnancy, childbirth or a related medical condition, such as lactation, unless the accommodation would cause an undue hardship. Among other possibilities, reasonable accommodations could include:

- Acquisition or modification of equipment or devices.

- More frequent or longer break periods or periodic rest.

- Parking modification.

- Assistance with manual labor.

- Modification of work schedules or job assignments.

To submit a request:

- Email The Standard at ADAservices@standard.com.

- In your email, include:

- Your first and last name.

- The best way to contact you (phone number, email, etc.).

- Reason for the accommodation.

Once submitted, The Standard team will reach out to begin the interactive process necessary to discuss and determine any potential reasonable and effective accommodations.

How to request accommodations:

- Email ADAservices@standard.com with your full name, contact information, and reason for the accommodation request, or you may now text The Standard to be connected with a live representative (see tipsheet below).

- The Standard will initiate an interactive process to discuss possible accommodations.

Employee Resources:

NEW Standard portal leave details

How to report Intermittent leave in the Standard portal

FAQ – Reporting a Leave of Absence or File Short Term Disability Claim

FAQ – Managing Your Leave of Absence

Employee Submitting and Managing a Leave of Absence

Paid Leave Oregon Model Notice

Paid Leave Oregon Weekly Wage Calculator

Pregnancy Discrimination Notice

The Standard Two-Way Text Tipsheet (1)

The Standard Two-Way Text Tipsheet (2)

The Standard’s Certification Forms:

- Certification of Health Care Provider for Employee’s Own Health Condition or Pregnancy

- Certification Form for Family Member’s Health Condition

Family Member includes a leave for Child, Parent, Spouse, Partner, Parent-in-law, Grandparent, Grandchild, Relative

Leader Resources:

FAQ- Managing Employee Absences

FAQ – Return to Work & ADA for Leaders

Pregnancy Discrimination Notice

Leave of Absence Standard Work for Leaders

Leadership course: Absence Management

Absence Process for Leaders including legislative updates

Leader File for Leave of Absence on behalf of employee

Access Reports in Standard portal

Health Insurance:

[1] OAR 839-009-0270(6)(b) [2]OAR 471-070-1330(7)(b)

The Standard portal account:

Creating a portal account: All employees, whether an individual employee or an HR/Corporate user, create and login to their online account the same way. Please start by going to the absence home page. First time users will need to create an online account which can be accessed here. Embedded in the website is a step-by step guide to creating an online account this link will take you directly to the guide.

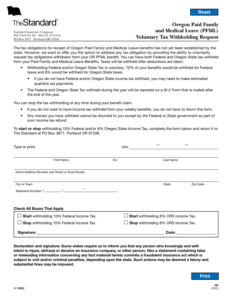

Tax Forms:

The Standard will send a W-2 by the end of January each year to employees who received any amount from The Standard. The W-2 will include how much the employee received in benefits and any federal or state tax withholdings. The IRS and Oregon Department of Revenue also receive a copy of this W-2.

OR PFML Benefits – Voluntary Tax Withholding Request

The Oregon Paid Family and Medical Leave (PFML) Voluntary Tax Withholding Request form is included in your leave paperwork, an additional copy is available below, in the event that your paid leave is approved. It is our understanding that Federal Income Tax and State Income Tax (when applicable) should be withheld from your paid leave benefits. If you have questions on how to complete the form, you should contact your tax advisor. If a completed Voluntary Tax form is not provided to us at the time the paid leave benefit is ready to be paid, we will not withhold Federal Income Tax or State Income Tax (when applicable), and you will be responsible for paying these taxes at year-end. Please be aware, we are not able to go back and refund any excess withholding from any benefits already issued.

While your paid leave benefit is being paid, if you wish to change the withholding selection indicated on your Voluntary Tax form, you may contact our office to request a new Voluntary Tax form. The new withholding will start with the first payment issued after we receive the new Voluntary Tax form.

Paid Time Off

Salem Health provides time off to eligible employees in the form of Paid Time Off and Oregon Paid Sick Leave. Paid Time Off benefits apply only to regular full-time and part-time employees. All employees are eligible for Oregon Paid Sick Leave.

For more detail, see the policy.

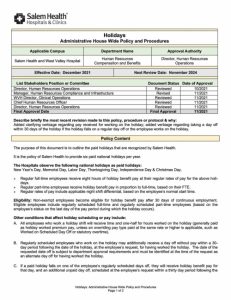

Company Paid Holidays

Salem Health observes the following national holidays as paid holidays:

- New Year’s Day

- Memorial Day

- Juneteenth

- Labor Day

- Thanksgiving Day

- Independence Day

- Christmas Day

For more detail, see policy below.