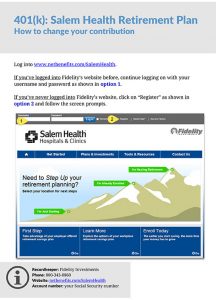

Fidelity was at Salem Health on July 12th to discuss our 401(k) Retirement Plan. A recording of the session is now available here. The slideshow can be accessed below:

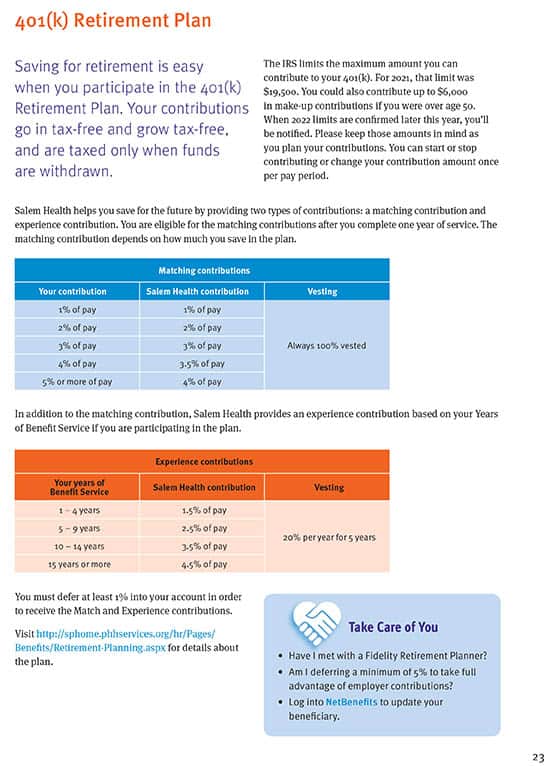

Saving for retirement is easy when you participate in the 401(k) Retirement Plan.

How the 401(k) Retirement Plan Works

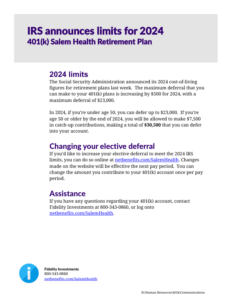

The IRS limits the maximum amount you can contribute to your 401(k). For 2024, that limit has been increased to $23,000 up through age 49, or $30,500 if age 50+. You can start, stop, or change your contribution amount once per pay period.

Salem Health provides two types of contributions for enrolled participants:

- Matching contribution – qualify after one Year of Eligible Service and begin receiving contributions the first pay period after completing one Year of Eligible Service

- Experience contribution – for eligible participating employees (those who contribute 1% or more of salary), Salem Health will make an additional contribution based on your Years of Service in a benefit eligible position the pay period following that achievement.

Special rules apply if you have periods of broken service during your Year of Benefit Service.

Click to view the Live Web Workshop catalog and enroll for a live web workshop, or click to view the complete OnDemand catalog and watch workshops at your convenience.

Matching Contributions

| Matching contributions | ||||

|---|---|---|---|---|

| Your contribution | Salem Health contribution | Vesting | ||

| 1% of pay | 1% of pay | Always 100% vested | ||

| 2% of pay | 2% of pay | Always 100% vested | ||

| 3% of pay | 3% of pay | Always 100% vested | ||

| 4% of pay | 3.5% of pay | Always 100% vested | ||

| 5% or more of pay | 4% of pay | Always 100% vested | ||

Experience Contributions

Employees who have completed one year of service in a benefits-eligible position become eligible for experience contributions when eligible to partcipate in the 401(k) plan.

| Your years of Benefit Service | Salem Health will contribute |

|---|---|

| 1-4 years | 1.5% of pay |

| 5 -9 years | 2.5% of pay |

| 10 -14 years | 3.5% of pay |

| 15 years or more | 4.5% of pay |

| Vesting |

|---|

|

20% per year for 5 years |